The Toronto housing market is headed for even more polarization according to BMO Economics’ latest weekly financial digest. Senior Economist Robert Kavcic believes detached houses will continue to be a hot commodity while condo prices could be in for “much more subdued growth, even stagnation for smaller units” by the end of the decade.

The prediction is in-line with recent reports regarding new low-rise and high-rise home prices in the GTA: in February, the price gap between the housing types reached $289,906 in February.

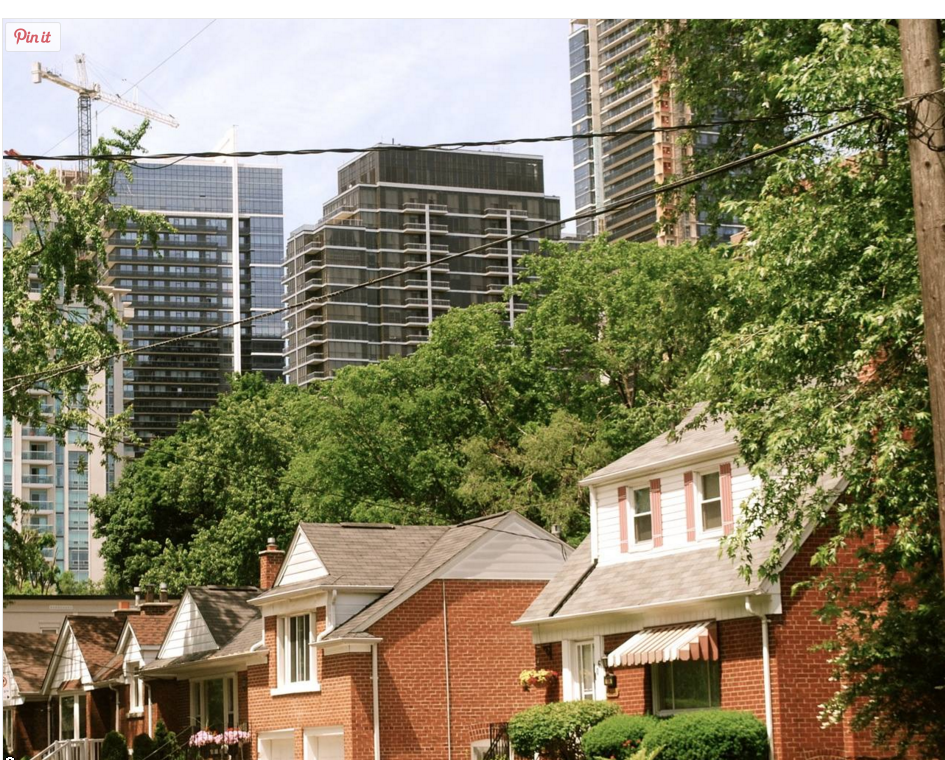

Development rules and demographic shifts have led to shake-ups in supply that will have a long-term impact on the market.

Kavcic disagrees with housing bears who have sounded the alarm over a glut of new homes in the Toronto region. At the end of last year there were 57,000 condo units under construction compared to 7,200 single-detached houses, the widest gap since the 1960s and a low amount for a non-recession period. Total residential completions fell in below the the estimated household formation in 2014, which was estimated to be in the 35,000 to 38,000 range.

“Toronto is not building too many homes, but rather the composition of the housing stock is changing dramatically —

buyers used to move out of the city for more affordable real estate, but they now have to effectively move ‘up’ the city,” he writes.

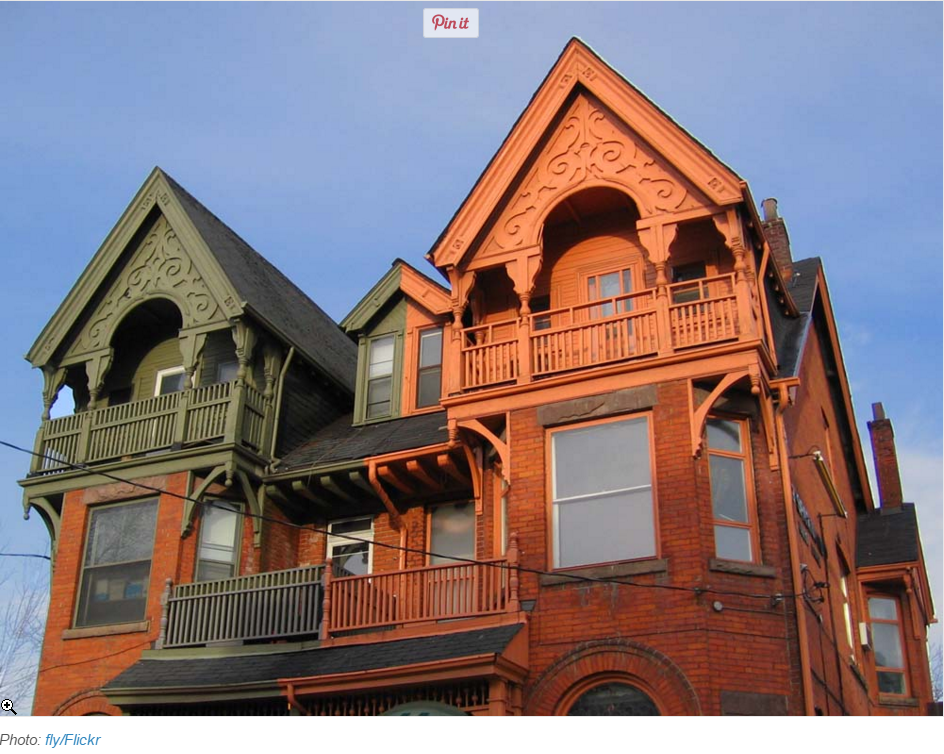

Because of Ontario Greenbelt rules that prevent development in the areas encircling the Greater Golden Horseshoe – made up of the Greater Toronto, Hamilton and Niagara region – expansive 50 to 75 foot-wide lots will become a “relic of the past.”

However, there is still room to grow. Kavcic notes that although the Toronto region is “now effectively an island,” statistics suggest there remains roughly 56,000 hectares of land in the ring around the city that is able to support development for the next 15 years.

While detached houses with big backyards are being built with less frequency, the demand remains. The number of buyers who gravitate towards the single family home with a backyard is on the upswing. The report indicates the population of 35 and 39-year olds is now accelerating while the 40 to 44 demographic is expected to see their numbers increase over the next few years, boosting demand for the increasingly rare housing style.

On the other hand, the key condo-buying demographic, 24 to 34-year olds, has started to stall.

In other words: don’t expect any deals on detached houses any time soon. Unless there’s a major economic shock, Kavcic believes the price gap between condos and detached homes will continue to grow through the end of the decade. Larger attached homes with two or three bedrooms will be caught up on the upward trend as well.

Read the full post in BuzzBuzzHome